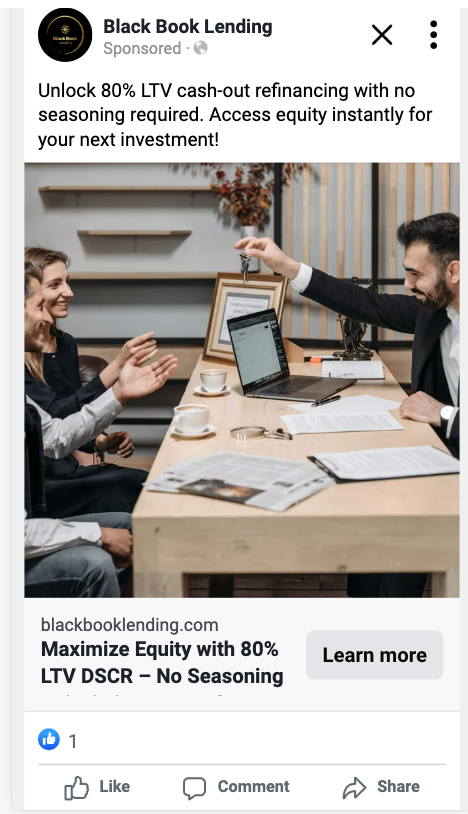

Unlock Quick Real Estate Profits with Flexible Transactional Funding – Close Deals Fast!

This ad is about transactional funding for real estate investors, focusing on the value proposition of Black Book Lending. It highlights key benefits like 100% funding coverage, no credit checks, fast approvals within 24 hours, and the ability to close deals quickly and confidently. The goal is to attract both new and experienced wholesalers by addressing their pain points (funding delays, lack of capital) and positioning Black Book Lending as the ultimate solution to help them succeed.

Need Fast Capital for Your Next Real Estate Deal?

Black Book Lending's Transactional Funding has you covered!

💰 Fast Funding: We can provide same-day capital for double-closing real estate transactions.

📈 Low Rates: Competitive pricing to maximize your profits.

✅ No Credit Check: Your deal is the only thing that matters to us.

🔒 Risk-Free: We fund deals with secure, predetermined buyer contracts.

Stop letting capital delays hold up your success! With Black Book Lending, you can close deals quickly and confidently.

Compliance Notice

What This Means Marketing Wise (Ads)

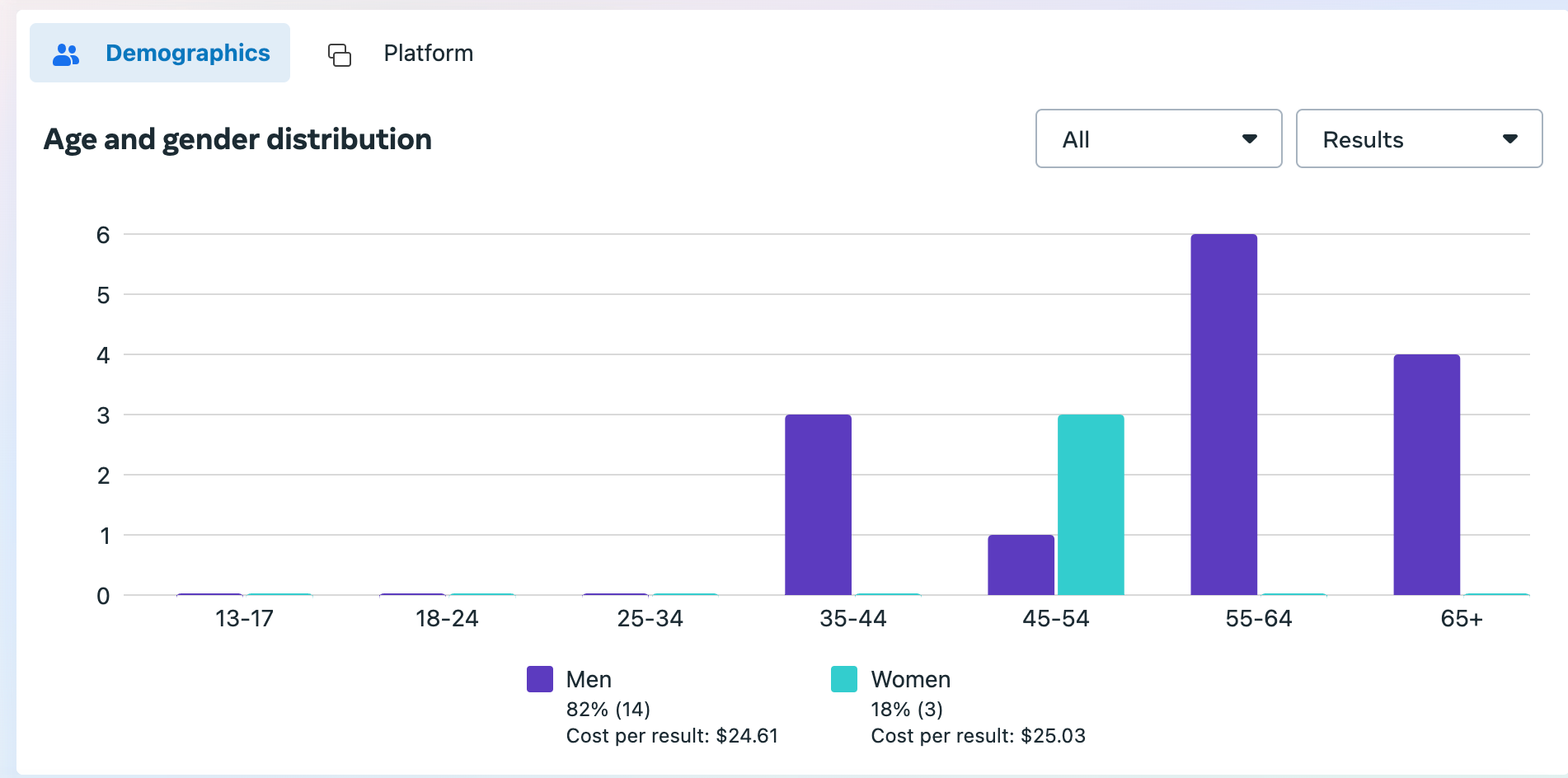

1. Audience Targeting Restrictions

- Limited Demographics: You cannot target users by age, gender, or ZIP code. This is to prevent discriminatory practices.

- Reduced Targeting Options: You are restricted from using detailed targeting categories like:

- Income

- Ethnic affinity

- Credit score

- Homeownership status

- Geographic Targeting: You can only use broader location targeting (like city or state level) but cannot target granular ZIP codes.

2. Ad Content Compliance

- The language in your ads must be clear, transparent, and non-misleading.

- You must avoid any terms that could be considered discriminatory or unclear, like:

- "Guaranteed approval"

- "Bad credit? No problem"

- False urgency or financial outcomes (e.g., "Double your money overnight").

- Disclaimers must be included to ensure compliance with financial advertising laws.

3. Special Category Declaration

- When setting up your campaign, you must check "Special Ad Category" (e.g., “Credit” for financial services). Failure to declare it can lead to ad disapproval or account suspension.

- This declaration triggers automated reviews and ensures your ads meet regulatory standards.

4. Ad Placement and Optimization

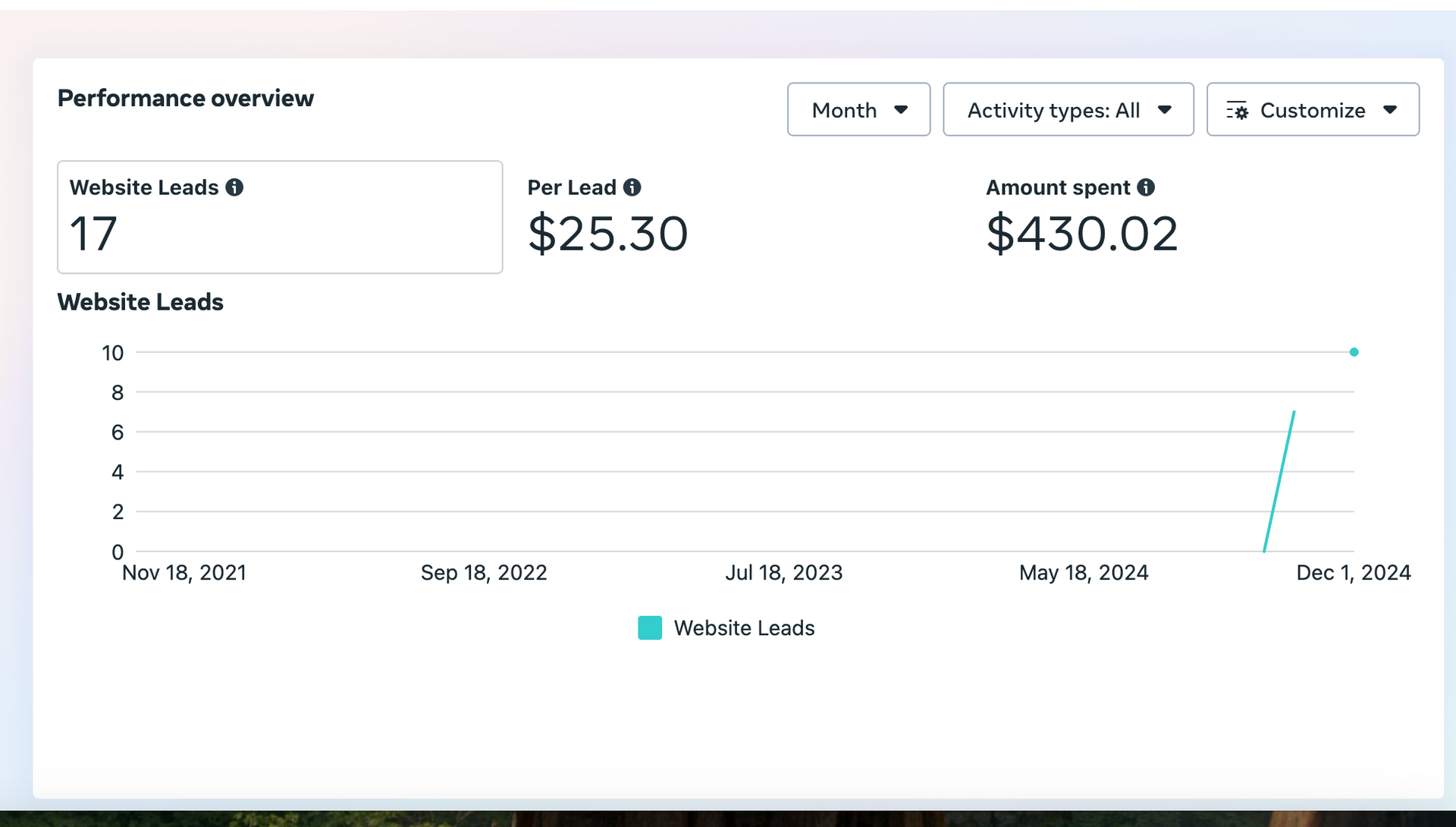

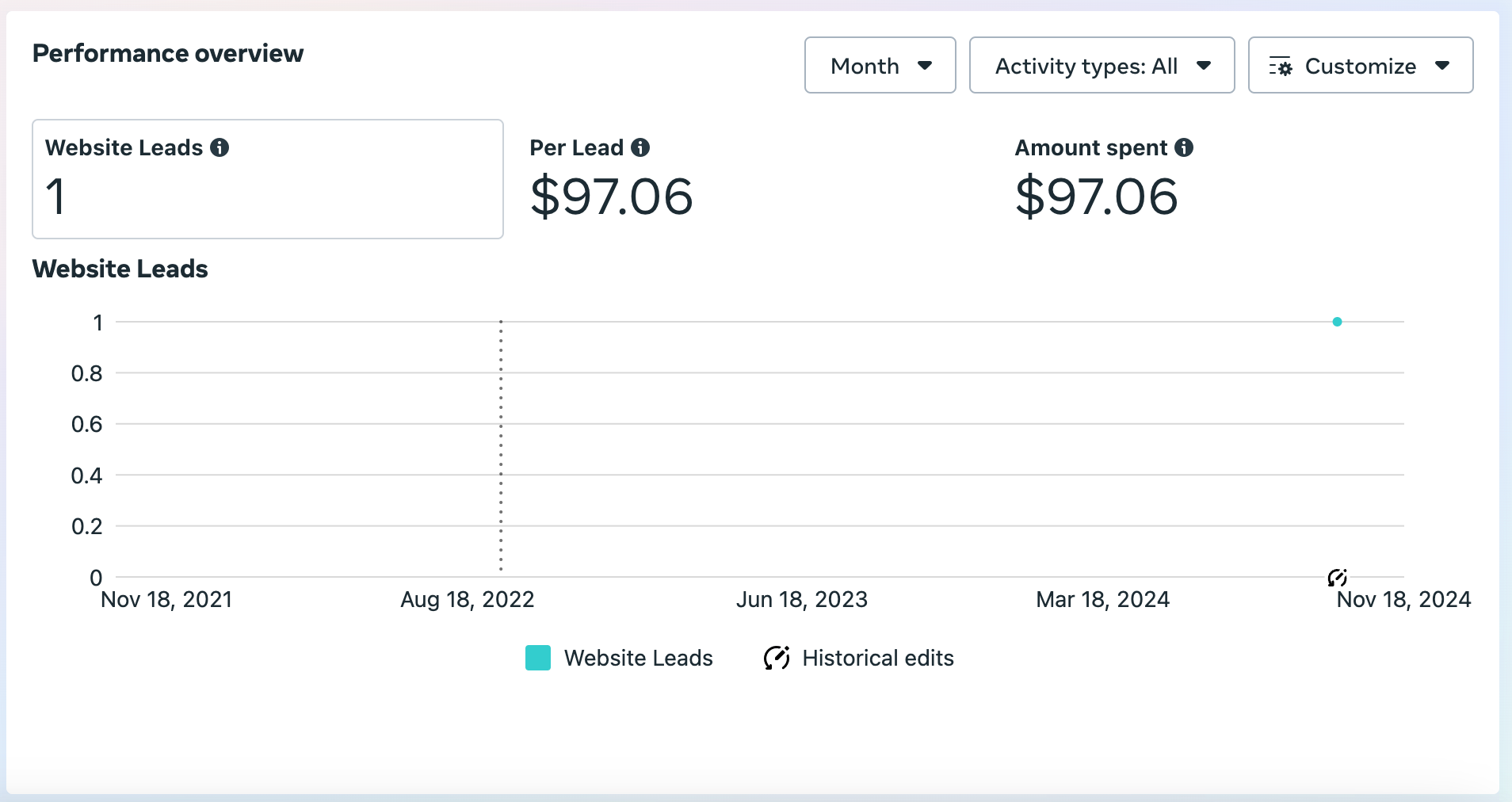

- Audience Reach May Be Broader: Without the ability to hyper-target, your ads will rely more on Meta’s AI to optimize delivery to users who are likely to engage with the ad.

- Expect higher costs per lead if not optimized well, as targeting precision is reduced.

5. Custom Audiences Limitations

- You can use Custom Audiences and Lookalike Audiences, but the Lookalike Audience will be adjusted for inclusivity and may no longer offer narrow matches.

- This ensures fairness and prevents exclusion of any protected group.

Practical Example for Financial Ads:

If you're running ads for real estate financing:

- You must declare "Credit" or "Housing" under the Special Ad Category.

- You can:

- Target broadly at a city/state level.

- Use general interests like "real estate investing" or "property development."

- You cannot:

- Target by age, ZIP code, or income bracket.

- Use phrases like “Lowest rates for those with great credit.”

By adhering to these limitations, you ensure your ads comply with fair advertising policies under anti-discrimination laws like the Fair Housing Act (FHA) or Equal Credit Opportunity Act (ECOA).

Google Ads

Key Takeaways:

Advertisers promoting financial products or services are required to provide:

- The physical address for the business offering the financial product or service

- Associated fees

- Links to third-party accreditation or endorsement where affiliation is asserted or implied, particularly when it serves to improve the reputation of the site

Examples (non-exhaustive): Verification of government affiliation, third-party ratings

Note: Disclosures can’t be posted as roll-over text or made available through another link or tab. They must be clearly and immediately visible without needing to click or hover over anything.